can you work part time and collect social security disability

To qualify for Social Security benefits youll need to earn 40 quarters of coverage. But both SSI and Social Security Disability have rules that govern the treatment of work activity.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

If you are receiving benefits and working in 2022 but not due to hit FRA until a later year the earnings limit is 19560.

. Starting with the month you reach full retirement age we will not reduce your benefits no matter how much you earn. However your monthly earnings may cause your disability benefits to be suspended or even terminated. No new application or disability decision is needed to receive a Social Security disability benefit during this period.

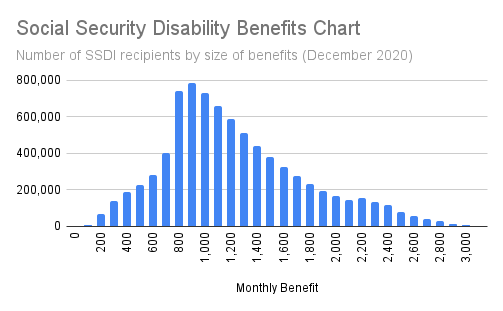

If you have a disability claim but are also working or thinking of returning to work and are unsure of how to proceed please call us at 412-794-8003 locally in the Pittsburgh area or toll. It is possible to work part time but this can make it harder to prove you cannot work full time. The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems.

You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year. For example in 2021 you cannot make more than 1310 a month and still qualify. Yes you are allowed to work if you receive Social Security Disability or receive SSI disability.

Ad See if You Qualify for up to 314800 per month. To make it easier for you to go back to work they offer a nine-month trial period. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

It is true that workers cannot receive unemployment benefits and SSDI at the same time because the qualifications contradict each other but disability benefits are different. So yes you can work while on social security disability. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits.

This answer addresses SSDI. In New Jersey its considered fraud if you work and collect Temporary Disability Insurance. Free Case Review Start Now.

There are no rules that prevent you from receiving both workers. Above that level youll lose 1 in benefits for every 2 earned. By working with Disability Advocates Group you increase the likelihood of obtaining the benefits you deserve.

The SGA for 2018 is set at. Before we get into your options we should first explain how much you can make on disability. So if you have a part-time job that pays 25000 a year 5440 over the limit Social Security will deduct 2720 in benefits.

You lose 1 in benefits for every 2 earned over the cap. If you receive Social Security Disability you are allowed to work. However your eligibility largely depends on how much you make while working.

For example if you were to work 16 hours a week making 16 per hour your monthly income would be about 1100 which falls under the SGA amount. If you earn over a certain amount however your benefits will be. Cannot be more than the maximum benefit allowed currently 170 per week WCL 204.

If you or a loved one needs help obtaining disability benefits there may be opportunities to work part-time however the SGA income limits can be complicated and confusing. If youre working part-time and are earning more than the maximum amount per month set by the SSA then your eligibility for SS disability benefits could be in jeopardy. Some workers think that they cannot receive SSDI and workers compensation simultaneously.

36 months during which you can work and still receive benefits for any month your earnings arent substantial In 2022 we consider earnings over 1350 2260 if youre blind to be substantial. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. This disability planner page lists some of the circumstances that can change your eligibility for benefits after you start receiving them how often we review your case to check whether you are still disabled the two things that can cause Social Security to decide that you are no longer disabled and what happens if you go back to work while you are receiving benefits.

Many beneficiaries dont know about the Social Security Administrations SSA work allowances because the majority of SSDI beneficiaries can no longer work in their usual. Despite the stringent total disability standards applicable to Social Security Disability Insurance SSDI claimants some beneficiaries can work part-time while receiving SSDI benefits. According to the AARP bookkeeping is the most popular part-time position for workers of a certain ageThis makes some sense.

You can get Social Security retirement benefits and work at the same time. In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial. You can collect Social Security retirement benefits at age 62 and still work.

The Social Security Administration SSA notes that you cannot make more than a certain amount of money to qualify for benefits. Yes you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security Administration SSA. Available In All 50 States.

Below we discuss the options you might have to work while on disability. But in some cases you may take part in work incentives while receiving the full amount of SSDI. Based on this you would think that working part-time while collecting SSDI benefits would be a definite no-no But surprisingly thats not the case.

The most important thing to remember is that trying to work does not in any way lessen your chances of receiving Social Security disability benefits. The income limit depends on what benefit you are receiving. It is possible to receive Social Security disability benefits if you are working part-time.

You can receive full benefits for nine months while making over the. For beneficiaries who work while collecting Social Security those younger than full retirement age can earn up to 17040 in 2018 without being penalized up from 16920 in 2017. 1180 per month for non-blind applicants.

However you must either be part of a program or make less than a certain amount each month. The amount of income you can make and continue to qualify for SSI is different This SGA limit allows many disability recipients to do some part-time work. However there are strict limits as to how much you can work and earn while getting Social Security Disability Insurance SSDI.

If you are on SSDI already you cant start making the SGA amount regularly. You can earn a maximum of four. 1 day ago40 Quarters of Coverage.

You can work part-time and still get disability benefits. Are You Taking Part in One of Social Securitys Work Incentives Programs. Apply For Social Security Disability.

The SSA wants you to work so the amount of benefits they have to pay out is reduced. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits. How much can I make on disability.

However if you are younger than full retirement age and make more than the yearly earnings limit we will reduce your benefit. Therefore most recipients receive SSDI in place of working.

Alzheimer S Disease And Social Security Benefits Alzheimer S Dementia Resource Center

8 Things Everyone Wants To Know About Social Security Becu

How To Get Social Security Benefits If You Ve Never Worked A Day In Your Life The Motley Fool

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Work Comp Audit Can You Collect Both Worker S Comp And Social Secu Social Security Benefits Social Security Disability Benefits Social Security Disability

How Much You Can Work Depends On Whether You Collect Ssdi Or Social Security Disability Benefits Social Security Benefits Retirement Social Security Disability

Program Explainer Special Minimum Benefit

The 1 Thing Nearly Everyone Forgets About Reagan S Social Security Reforms In 1983 The Motley Fool

How Long Do I Have To Work To Qualify For Ssdi

Full Retirement Age For Getting Social Security The Motley Fool

How Long Term Disability Works With Social Security Disability Cck Law

8 Things Everyone Wants To Know About Social Security Becu

Social Security Disability Vs Short Term Disability

Breaking Down Social Security Retirement Benefits By Age Simplywise

Social Security Types Payouts The Program S Future

Social Security Child S Insurance Benefits Benefits Gov

Social Security Disability For Legally Blind Americans

/what-you-must-know-about-the-social-security-debit-card-47c8b082ff2740a9a836e074fc5a6253.png)

What You Must Know About The Social Security Debit Card

How Much In Social Security Disability Benefits Can You Get Disabilitysecrets